In recent months, the price of gold has experienced a significant rally, climbing more than 50% over the past year. To casual observers, this may seem like just another phase in the ebb and flow of commodity prices. However, to seasoned investors and economists, such a sharp increase often carries deeper implications. Historically, a surge in gold prices has preceded major economic crises. So the question emerges: Is gold once again warning us of an approaching financial storm?

A Historical Pattern: Gold as a Crisis Predictor

A Historical Pattern: Gold as a Crisis Predictor

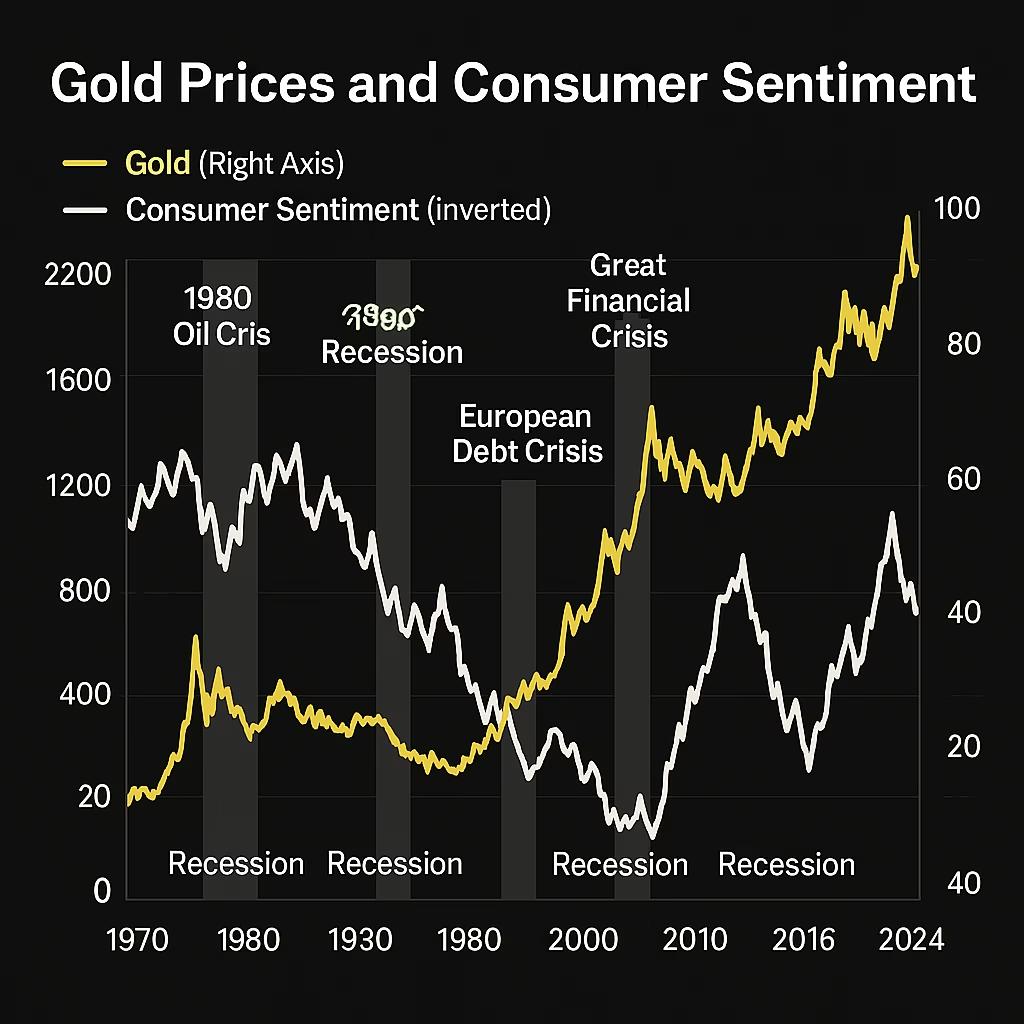

Gold has long been considered a safe haven asset—something investors flock to when they anticipate economic trouble. This reputation isn’t just theoretical; it’s grounded in historical precedent.

- In 1973, gold surged by 50% ahead of a deep recession.

- In 1980, it experienced a similar spike just before another significant economic downturn.

- In 2008, gold again rose 50% in the six months preceding the Great Financial Crisis, as the global financial system teetered on collapse.

These examples suggest a strong correlation between rising gold prices and mounting economic instability.

Today, we are seeing another sharp increase—a 50% gain in gold prices over the past 12 months. Though the current rise has been more gradual than the explosive spike before 2008, the upward momentum hasn’t shown signs of slowing. Once again, investors are piling into gold, seeking safety in a world filled with uncertainty.

Consumer Sentiment: A Mirror Image of Gold

One of the most telling indicators of economic health is consumer sentiment, and right now, that sentiment is bleak. According to data from the University of Michigan’s Consumer Sentiment Index, Americans’ outlook on the economy is at one of its lowest points in 40 years. This level is comparable to periods like:

- The Great Financial Crisis (2008)

- The recession of 1990

- The stagflation of the early 1980s

- The oil shock of 1979

- The downturn of 1970

Interestingly, when we compare consumer sentiment to gold prices—and flip the sentiment index upside down—we see a striking alignment. Historically, when gold goes on a bull run, consumer sentiment drops. This was clearly visible between 2004 and 2011 and is repeating itself again since 2017.

This inverse relationship supports the idea that rising gold prices are not a sign of economic optimism. Quite the opposite: they reflect fear, uncertainty, and declining faith in economic stability.

What’s Different This Time? The K-Shaped Recovery

Past episodes of low consumer sentiment were typically accompanied by other signs of recession:

- High unemployment

- Falling stock markets

- Negative GDP growth

Yet, none of those signs are currently present in the U.S. economy.

- The stock market has been on one of the strongest runs in history.

- The unemployment rate remains low.

- GDP is still expanding, albeit unevenly.

So, how do we reconcile strong financial markets with gloomy public sentiment?

The answer may lie in the now well-known concept of the K-shaped recovery. This describes a post-crisis economy where different parts of society recover at vastly different speeds. Wealthier individuals with assets—stocks, real estate, business holdings—have seen their net worth soar. Meanwhile, the average worker struggles with high inflation, stagnant wages, and rising living costs.

This divergence is pushing consumer sentiment to historically low levels, even while the broader economy appears robust on paper.

The Debt Dilemma: A Nation Living Beyond Its Means

A closer look at the U.S. government’s finances reveals another major source of concern: soaring federal debt.

Since the 1960s, the national debt has trended upward. But around 2008, the trajectory turned sharply parabolic. This trend accelerated even further during the COVID-19 pandemic, when emergency stimulus packages and economic relief measures were introduced at an unprecedented scale.

For most of modern history, U.S. GDP (the economy’s total output) exceeded the size of the national debt. That changed in 2020. For the first time, the federal debt surged significantly above GDP, creating a troubling imbalance.

This has profound implications:

- The government faces mounting interest payments on its debt.

- It has less flexibility to increase spending during economic downturns.

- It may be forced to consider cutting programs like Social Security or raising taxes—or both.

All of these actions would place even more pressure on the average American, who already feels economically squeezed. This disconnect between rising financial markets and deteriorating personal finances is fueling pessimism—and driving gold higher.

Policy Proposals: A Possible Path Forward

There is, however, some hope on the horizon. One policy proposal under consideration is the elimination of federal income taxes for middle- and lower-income Americans, as floated by the Trump administration.

This idea, while ambitious, could significantly boost consumer purchasing power and potentially reinvigorate the “real economy.” However, the suggested method of financing it—tariffs on imported goods—comes with trade-offs:

- Tariffs can reduce corporate profit margins.

- They often lead to retaliatory measures from trade partners, escalating geopolitical tensions.

- Increased costs on imported goods may lead to higher consumer prices, negating some of the benefits.

Moreover, these uncertainties—trade wars, shifting global alliances, and unstable profit margins—could themselves drive gold prices even higher, as investors hedge against chaos.

What Investors Are Doing: Strategic Positioning

At Bravo Research, analysts have been long on gold throughout this bull market, capitalizing on its upward trajectory with strong, profitable trades. But as gold becomes more extended, they’ve begun booking profits, signaling caution while remaining vigilant.

Their investment strategy reflects a belief that while gold may continue to rise in the short term, it’s essential to adapt as the market evolves. If fiscal and economic reforms take root—like income tax relief or successful deficit management—consumer sentiment could improve, and gold may start to level off.

Final Thoughts: A World at a Crossroads

Gold doesn’t just reflect market speculation—it reflects fear, uncertainty, and declining trust in traditional financial systems. Its 50% rally over the past year is a clear signal that investors and everyday people alike are bracing for economic turbulence.

Whether that turbulence takes the form of another financial crisis, a spike in inflation, or geopolitical instability remains to be seen. But one thing is clear: the economy is not out of the woods, and gold’s performance is a glaring red flag.

In this environment, staying informed, diversified, and strategically positioned is more important than ever.

🟡 TL;DR

- Gold has risen 50% in the past year, historically a sign of approaching crisis.

- Consumer sentiment is near historic lows—despite a booming stock market.

- Federal debt has surpassed GDP, limiting the government’s ability to stimulate.

- Policy proposals could offer relief but come with trade-offs.

- Gold is a hedge—but not a forever bet. Strategic exits matter.